Blog

BLOG

Opinion and economic analysis

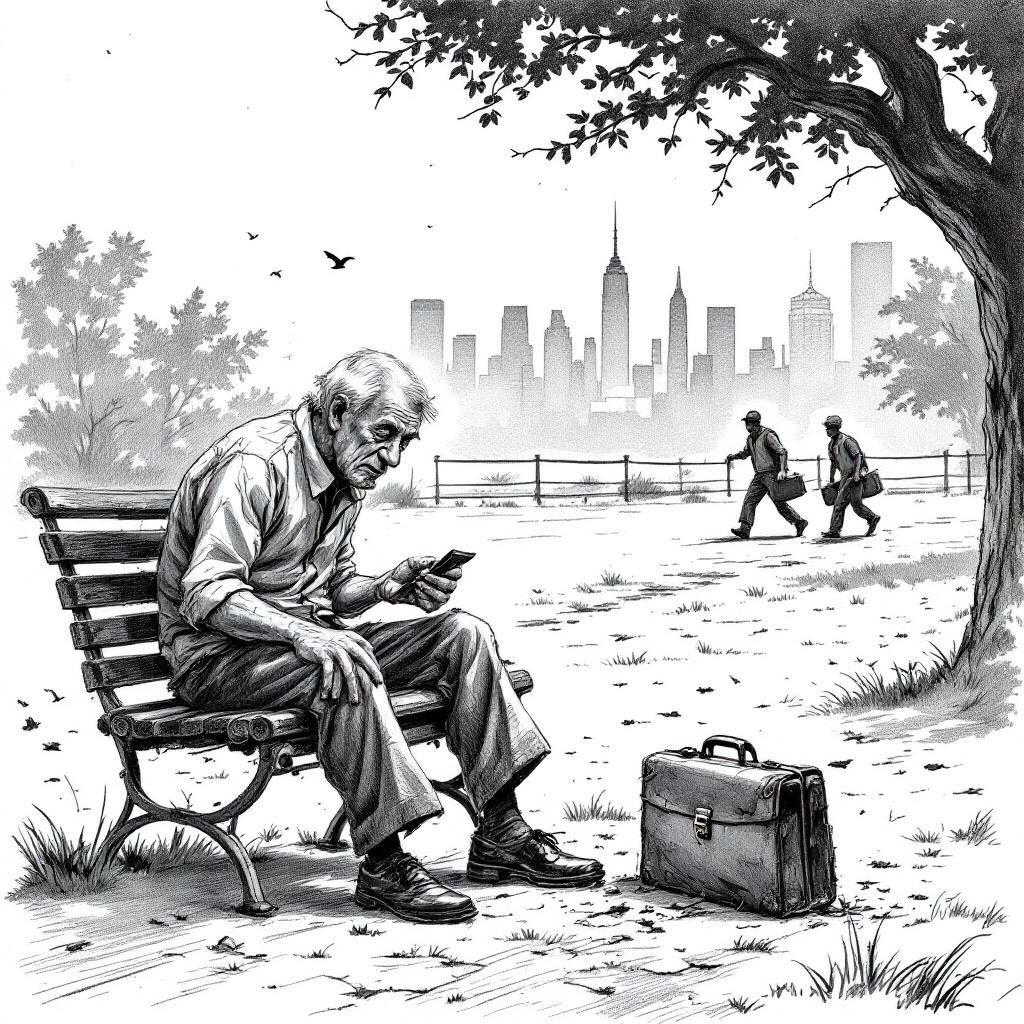

RETIREMENT AT 70? THE COST OF PRECARITY FOR YOUNG PEOPLE.

Labor precarity is already shaping the type of retirement that young Spaniards will be able to aspire to in four decades. And it will do so regressively, amplifying social and economic inequalities throughout their lives.

In 2024, the youth employment rate (43.2%) remains 15 points below pre-2008 financial crisis levels. This delay in entering the labor market stems from an economic model that, far from rewarding educational investment or mobility, systematically penalizes young workers with unstable contracts and fragmented career paths.

One in four young people works part-time —double the national average— and more than a third are employed under temporary contracts. In addition, their wages are 34% lower than those of the general workforce. This triple condition —temporariness, part-time work, and low pay— creates a real barrier to starting a solid contributory career, which in turn will have direct consequences on their future pensions.

What’s most concerning is that, unlike previous generations, today’s young people take longer to reach stable contribution bases. Whereas this used to happen before the age of 27, today even by age 34 they haven’t reached the average.

Under current rules, a person must contribute for at least 40 years to retire at 65 with a 90% replacement rate, that is, to maintain their pre-retirement standard of living. But if most young people only begin contributing significantly from age 30 onwards, reaching that target would require retiring at 70 or 71. An age that not everyone will reach in good physical condition or health.

With only 30 years of contributions, maintaining a decent standard of living would require working six additional years. And with 35 years of contributions, at least three more.

One factor that exacerbates generational tension is the implementation of the Intergenerational Equity Mechanism (MEI), which increases contributions to replenish the reserve fund without translating into greater rights for contributors. In fact, today’s youth —who are already contributing more than previous generations— will receive proportionally lower pensions in relation to their final salaries. Paying more to receive less.

In this context, the three core principles of the pension system —sufficiency, sustainability, and equity— face serious challenges. Sufficiency, because pensions derived from short careers and low wages will simply be inadequate. Sustainability, because if young people cannot contribute at the required level, the system cannot be funded. And equity, because young people are financing today’s retirees while being denied a reasonable expectation of a decent future pension.

A comprehensive redesign is urgently needed, one that finally acknowledges that 21st-century career paths do not resemble those of the 20th century. Some essential proposals:

- Recognition of contribution gaps: Adapt the system to account for periods without contributions due to job instability or time spent in training, already a reality in other European countries.

- Guaranteed minimum pensions: Move toward a universal base pension model that ensures a decent minimum level, supplemented by contributory earnings.

- Promotion of real complementary plans: Encourage private retirement savings, but with progressive and accessible tax incentives for middle and low income earners.

- Quality youth employment as a pension policy: Directly link youth employment policies to pension system objectives. There will be no sustainable pensions without sustainable jobs for the young.

Spanish youth is not lost. It has been sidelined. But there is still time to change course. This is not about protecting the elderly or the young. It’s about balancing the system so it works for everyone, today and tomorrow.

If we don’t act now, the problem won’t just be that young people don’t make it to retirement on time. It’s that many will arrive late, in poor shape… or not at all.